Many of us have a clue about the concept of inflation and deflation. After all, there were many instances in history where hyperinflation has spelt trouble in society. This includes the hyperinflation of the Hungarian Pengő after the Second World War, the 2007 Zimbabwean Dollar, and more recently, the ongoing hyperinflation in Venezuela.

Today, we will be discussing the macroeconomics concept of inflation and deflation, together with their effect on the economy.

What is Inflation?

In economics, inflation occurs when the increase in the general price level (GPL) of an economy is sustained. GPL refers to the average price of all goods and services in the economy. This means that it occurs across all sectors of the economy and is continued, rather than being just a one-time event.

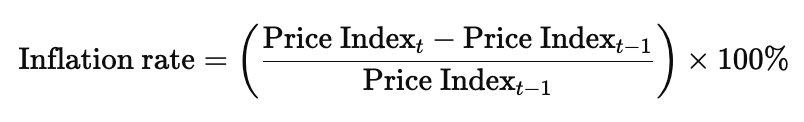

To measure the inflation rate, we can use the formula:

We also often measure the change in the GPL with the consumer price index (CPI). The CPI is responsible for measuring the changes in the price of a fixed basket of goods or services that the average household commonly buys over time. We calculate the CPI with respect to a base year, to which we assign a value of 100.

Degrees of Inflation

There are four degrees of inflation that we use to gauge its extent in an economy.

| Degree | Inflation Rate (x) | Effect |

| Mild Inflation | 0% < x < 3% per year | The economy enjoys price stability and is favourable for economic growth – governments target inflation of 2%. |

| Moderate Inflation | 3% < x < 10% per year | Prices are stable but governments should intervene to prevent future complications. |

| Galloping Inflation | x > 10% per year | Prices are increasing rapidly and governments need to implement strict policies to minimise inflation. |

| Hyperinflation | x > 50% per month | Increases in prices are rapid, uncontrollable – economic agents start to use foreign currencies, and the bank needs to issue a new currency. |

Real Value of Money

In economics, the real value of money refers to the purchasing power of a unit of money. Simply put, it refers to how many goods or services that a unit of money can buy.

The real value of money is inversely related to the GPL. This means that inflation causes the real value of money to decrease and vice versa.

Types of Inflation

Demand-pull Inflation

In economics, the continued increase in aggregate demand (AD) when the economy is near or at full employment causes demand-pull inflation. Generally associated with booming economies, this causes an increase in the GPL as AD persistently exceeds aggregate supply (AS).

When there is an initial rise in the AD, profit-orientated producers will increase production and operate closer to full capacity. As such, production becomes less efficient and these producers will need to use less suitable resources for production. This means that producers need increasing amounts of factors of productions (FOPs) for each additional unit of output that they produce. While there is an initial increase in the national output, there is also an increase in the GPL. However, past full capacity, the GPL will continue to increase without any increase in national output.

Causes

As we have mentioned earlier, a rise in AD causes demand-pull inflation. This means that factors affecting the components of AD – consumer expenditure, investment expenditure, government expenditure, and net export revenue, will affect the AD. An increase in any of these non-monetary components results in demand-pull inflation.

On the other hand, monetary factors can also cause demand-pull inflation. When the money supply of a country increases, the money supply will increase and exceed the money demand. The public will then spend the excess money on goods and services, converting the excess money into physical assets. Since this causes an increase in the AD, prices may inflate if the economy is at full capacity. This occurs when there is too much money chasing after too few goods or services.

Cost-push Inflation

In economics, the continued increase in unit costs of production (UCOP) not caused by an increase in AD will cause cost-push inflation.

When there is an increase in UCOP, profit-orientated firms will only continue producing at the same output level if they receive higher prices. The horizontal AS will shift upwards and cause the equilibrium price to increase. However, there is a fall in equilibrium national output. With more cost-push inflation, the horizontal AS will continue to shift upwards and cause a continued increase to the GPL.

Causes

There are three main causes of cost-push inflation – imported, tax-push, and wage-push inflation.

Imported inflation occurs when an increase in the price of imported inputs causes cost-push inflation. These occur when there is an increase in prices of imported inputs crucial in producing a variety of products, such as crude oil. This occurs in countries that rely heavily on imported inputs, such as Hong Kong and Singapore.

Depreciation in the currency of a country can cause imported inflation since the price of imported inputs in local currency causes an increase in UCOP. As such, the horizontal AS shifts upwards and cause an increase in GPL.

Tax-push inflation occurs when indirect taxes, such as GST or VAT, causes an increase in the UCOP of goods and services. Producers will pass on these taxes to consumers by raising the prices to protect their profit margins. As such, the GPL will increase and so will the cost of living. Households will then ask for an increase in their pay to maintain their current purchasing power, causing further increases in UCOP. This leads to a multiplied increase in the GPL.

Wage-push inflation occurs when the labor force shrinks due to an ageing population or foreign policies. It may also occur when trade unions induce an increase in wages without increasing the demand for labor. When wage rates increase faster than labor productivity, the rising unit labor cost may cause inflation.

Effects of Inflation

For consumers, it will increase the cost of living – households have to spend more money to maintain the same level of the material standard of living. The impact on the standard of living depends on the inflation rate compared to the increase in the nominal income of households. If the nominal income of households increases slower than the GPL, there will be a fall in real income. As such, there is a lower material standard of living.

For producers, it will affect their profit margin. Demand-pull inflation will increase the profit margins of producers as GPL rises faster than UCOP. However, cost-push inflation will decrease the profit margin of producers, since the rise in UCOP is not due to an increase in AD. Firms will have to absorb the increase in UCOP as they cannot pass on the increase in UCOP to consumers.

For the government, it will affect many aspects – both macroeconomic and microeconomic.

On the macroeconomics side, it will cause the real value of money to fall. The public will then be encouraged to consume rather than save, and there are fewer funds for investment. That said, there is an increase in uncertainty of investment decisions during high levels of inflation. However, this depends on the cause.

The balance of trade of a country also depends on the inflation rate of that country compared to the other. This also corresponds to the foreign currency exchange concept we mentioned earlier.

On the microeconomics side, it can result in arbitrary income redistribution – some people will gain while others will lose. There is also a distortion in the price mechanism, which leads to a misallocation of resources.

What is Deflation?

In economics, deflation is the sustained decrease in the GPL that occurs when there is a negative inflation rate.

Types of Deflation

Demand-side Deflation

In economics, falling AD causes demand-side deflation. This type of deflation is often associated with serious economic recessions. It is inverse to the increase in AD, and thus demand-pull inflation.

When AD falls, firms will lower the output and cause a rise in unemployment. This allows firms to obtain better resources they need, giving rise to more efficient factor combinations and falling UCOP. As such, firms can sell output at lower prices, causing a fall in the GPL.

Supply-side Deflation

In economics, increasing AS causes supply-side deflation, since there is a decrease in GPL. It is inverse to the decrease in AS, and thus supply-push inflation. We consider supply-side deflation good deflation since national output rises.

When the UCOP falls, the horizontal AS shifts downwards, causing firms to increase the quantity supplied at each price level. Firms then cut prices to stimulate spending and reduce excess supply. This causes the GPL to fall persistently.

Effects of Deflation

There are many effects of deflation, but they are mostly the opposite of the effects of inflation.

For households, deflation causes a decrease in their cost of living. This means that there is an improvement in material standard of living. For producers, deflation will affect their profit margin, but opposite to how inflation would.

For the government, deflation will affect both macroeconomic and microeconomic goals. Similarly, deflation affects these goals in the other way.

Add comment