For many years, Economists have pondered over the central problem of Economics. If this is your first time hearing the questions, you may think that these problems are easy to solve. However, for those of us who have a basic understanding of Economics, we know that this is a very complex issue. In fact, the central problem of Economics is the very foundation of most parts of the Economics that we know today.

That said, let us discuss the central problem of Economics and other factors that we need to consider.

Central Problem of Economics

Before we begin, it is crucial for us to understand what the central problem of Economics is. There are three fundamental problems in Economics – for whom, how what, and how much goods and services should be produced. To address these questions, we must understand that resources are limited. As such, the market must allocate these scarce resources efficiently via the price mechanism.

Every market, every society, and every economy will encounter the central problem of Economics. This is due to the limited resources but unlimited human wants. As such, it is impossible to meet every wants as they outweigh the limited resources.

Resource Allocation

The problem of resource allocation boils down to two major factors – unlimited human wants and limited resources. These will result in the issue of scarcity, which is then solved by choice, which then results in opportunity cost. Essentially, the entire concept of resource allocation is a direct consequence of each other.

Scarcity

In Economics, scarcity occurs if the demand of the resource exceeds the available supply at zero price. Essentially, every resource is scarce – with the exception of free goods like sunlight and air.

Now that we have mentioned air, you may be surprised to find out that air may or may not be a scarce resource. While air, at zero price, is of unlimited supply, this may not apply to clean air. In some regions, we need to use scarce resources to obtain clean air. As such, the broadly defined “air” may or may not be scarce.

Choice

Scarcity is the root cause of one of the fundamental Economic challenges – choice. This means that as resources are scarce, we have to make choices. In Economics, choice is how we can allocate scarce resources among competing uses to satisfy the wants of humans.

Each Economic agent has to make choices. Consumers have to choose which goods or services to buy as they have a limited income and cannot buy anything they want. Producers have to choose what goods or services to produce and what factors of production (FOPs) to hire since they cannot afford everything. On top of that, governments have to choose how to allocate their spending due to their limited budget.

Opportunity Cost

When Economic agents make choices, they will incur an opportunity cost. In Economics, opportunity cost refers to the cost of using resources for a particular activity in terms of the net benefit that Economic agents could derive from the next best alternative forgone. This means that every time that we use a scarce resource to satisfy a human want, we have to sacrifice the next best want.

Factors of Production

In Economics, Factors of Production (FOPs) are resources used to produce goods and services in an economy. There are three main FOPs – Land, Labor, and Capital Stock. However, we sometimes also include a fourth FOP, Entrepreneur.

Land

In Economics, land is the natural resources that are used or are available for the production of goods or services. This includes both renewable and non-renewable natural resources – renewable natural resources renew themselves fast enough to provide sustainable economic growth. Rent is the factor payment for land.

Labor

In Economics, labor is the physical and mental effort of people that are used or are available for the production of goods or services. Wage is the factor payment for labor.

Capital Stock

In Economics, capital stock is all the man-made physical assets that are used or are available for the production of goods or services. There are two types of capital stock – circulating and fixed capital. Interest is the factor payment for capital stock.

Circulating capitals are raw materials or unfinished goods and services. They are stored in inventories and are waiting to be sold. On the other hand, fixed capital are durable items that we can use repeatedly to produce goods and services.

Entrepreneur

In Economics, entrepreneurs are people who combine FOPs to produce goods or services, innovate, and undertake production risks. They are responsible for making decisions in the firm. Profit is the factor payment for entrepreneurs.

Rational Decision Making

Objectives of Economic Agents

In Economics, we always assume that Economic agents are making decisions rationally. This is so that they can maximise their self-interests. Consumers aim to maximise their net total utility from the purchase of goods and services. Firms aim to maximise their net total profits from the production and sales of goods and services. Governments aim to maximise social welfare in deciding and implementing policies.

However, these Economic agents face an issue – constraint. Consumers have limited income, producers have limited finances, and governments have limited tax revenue. Essentially, they face budget constraints and limited money. Governments also have to face the level of acceptance of their policies, based on the social and political values of the public.

Marginalism

In Economics, marginalism, or marginalist principle, explains the discrepancy between the value of two goods or services based on their utility. It helps Economic agents to make decisions by weighing the marginal benefits and costs. Marginal benefit refers to the additional benefit gained from doing one more unit of activity, whereas marginal cost refers to the additional cost incurred from doing one more unit of activity.

Based on marginalism, it is rational for Economic agents to do the activity if the marginal benefit exceeds the marginal cost. This is due to the total benefit still exceeding the total cost of doing the activity. Ideally, the optimal level of activity is where the marginal benefit equals the marginal cost.

Production Possibility Curve

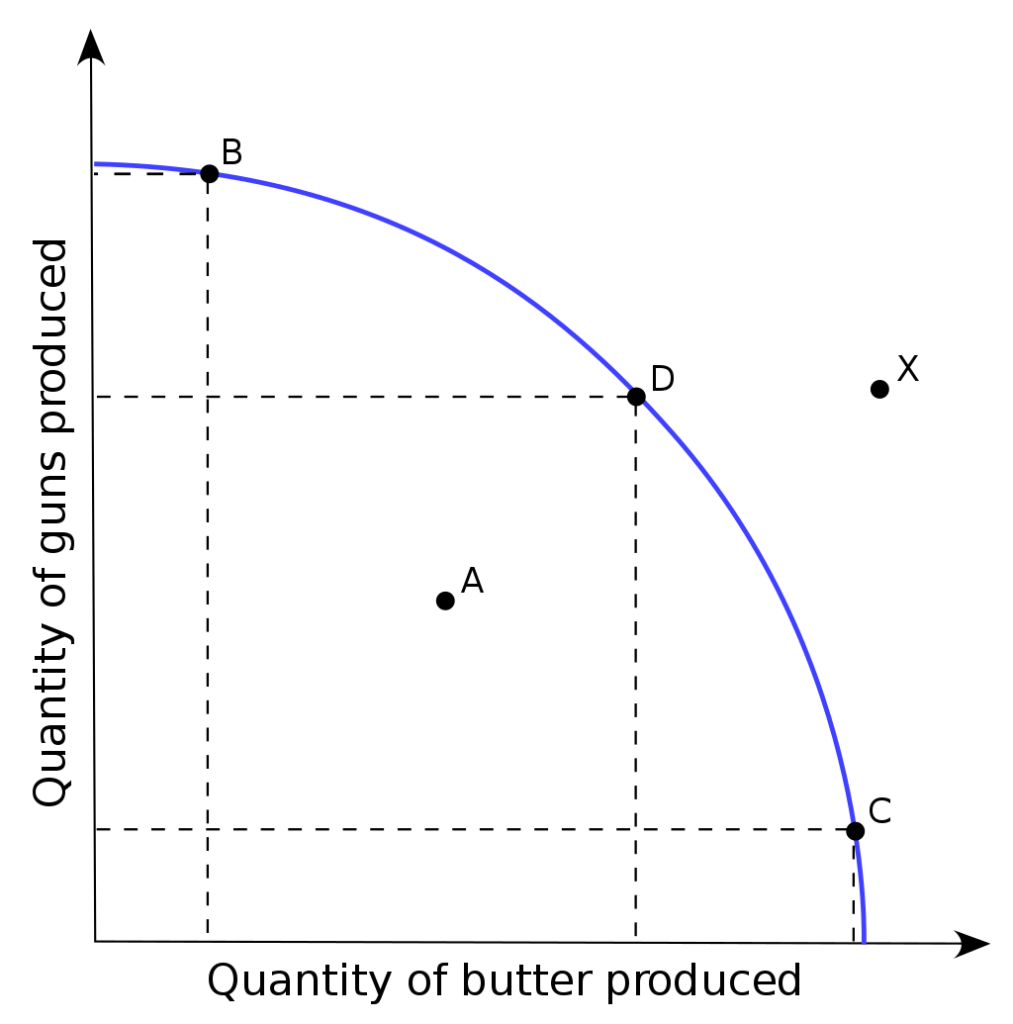

In Economics, we use the production possibility curve (PPC) to exhibit the maximum amount of two goods that an economy can produce in a certain time. We assume a fixed level of technology, and producers fully use and efficiently employ all available resources. Here is how a PPC curve looks like.

Interpreting the PPC

You can see five points on the PPC – A, B, C, D, and X. You would have noticed that A lies inside the PPC and X lies outside the PPC, whereas the remaining three points lie on the PPC. When a point, like X, lies outside the PPC, it means that it is impossible to attain that specific quantity of both goods. This is due to the concept of scarcity – unlimited wants but limited resources. On the other hand, we can attain any point on or inside the PPC.

Now, let us use the concept of choice. Points B, C, and D are lying on the PPC. This means that we can attain these quantities of goods, but we have to choose which goods to produce more or produce less due to scarcity.

When the points are lying on the PPC, the economy is in a state of productive efficiency. This means that the economy is producing goods or services at the maximum attainable output level based on its resources and technology. However, if the points, like A, lies inside the PPC, the economy is in a state of productive inefficiency. This means that the economy either is using resources inefficiently or are not using all available resources.

If the PPC shifts outwards, the productive capacity of the economy will increase. This occurs when there is an improvement or increase in resources or technology. In this aspect, it is somewhat similar to an increase in the aggregate supply.

Add comment